The influence of adoption rate reporting, marketing, and pricing strategies

Improved accuracy in reporting the hearing aid adoption rate, promoting hearing aid features using evidence-based data in language that the layman can understand, and unbundling prices are three things that our industry needs to improve upon. Furthermore, this article makes a case that—if properly promoted, distributed, and regulated—direct-to- consumer hearing aids may not pose the imminent threat to consumers and professionals that many in our industry fear.

Increasing market growth, or the demand for a given product or service, is the objective of every industry. In the hearing aid industry, market growth is estimated by the conventional adoption rate, or the percentage of impaired listeners who have purchased amplification technology relative to all listeners exhibiting impaired hearing. Since 1980, the US conventional hearing aid adoption rate has ranged between 17.50%1 and 24.60%.2 Given the historically stagnant adoption rate for this technology, we report here known factors that have impeded and continue to impede market growth.

Is the Market That Underserved?

Figure 1, taken from MarkeTrak VIII, shows the estimated number of Americans who are expected to exhibit a hearing loss between the years 1989 and 2050.2 Note that, during this 60-year period, the number of Americans with a hearing loss is estimated to increase by 28.2 million—or by an average of roughly 460,000 individuals annually. For the year 2012, extrapolated from Figure 1, an estimated 34.36 million Americans will experience some form of hearing loss (eg, sensorineural loss, losses with a conductive component, single-sided deafness, and losses better suited for cochlear implants), with an estimated 8.45 million Americans owning amplification technology (34.36 million impaired listeners x 24.60%). These data then suggest an untapped market of 25.91 million Americans (34.36 million impaired listeners—8.45 million hearing aid users).

Professional organizations, federal agencies, and hearing aid manufacturers—to name only a few—often portray the market as under-served because these 25.91 million Americans do not own a hearing aid. Use of the data in this manner overestimates the underserved market potential, as it is inconceivable to assume that all 25.91 million Americans who do not own a hearing aid actually want or need amplification technology.

A more precise estimate of the market can be determined using an economic model.3 This model considers those Americans who presently own a hearing aid, and concedes that some Americans do not want or need a hearing aid, with the difference being a more realistic estimate of the true untapped market.

Figure 1. Hearing industry estimates of hearing impairment in the United States based on MarkeTrak VIII.2

Figure 2. Willingness-to-pay results for hearing aid technology and professional service by framing condition as determined in the unbundled pricing strategy. Key: Prof Fee = professional fee for services; WDRC = wide-dynamic-range-compression; DIR = directional technology; NR = noise-reduction technology; Warr = service warranty related to device.

Figure 3. Post hoc analysis of Figure 2 that shows mean willingness-to-pay as a function of respondents’ experience with hearing aids. Key: Prof Fee = professional fee for services; WDRC = wide-dynamicrange-compression; DIR = directional technology; NR = noise-reduction technology; Warr = service warranty related to device.

For the year 2012, the economic model agrees that an estimated 34.36 million Americans will experience some form of hearing loss, and that 8.45 million of this population own a hearing aid. Of the 25.91 million Americans who exhibit a hearing loss, the economic model concedes that 17.88 million Americans do not want or need amplification. In other words, the untapped market for those Americans who do want or need a hearing aid is an estimated 8.03 million, suggesting an adoption rate of 51.28%.

Why are these differences in estimates important and what is their impact on the adoption rate? Consider, for example, that United Healthcare entered the hearing aid market to gain market share of the reportedly nearly 18 million underserved Americans who do not want or need a hearing aid, based on estimates derived using the conventional adoption rate.4 Had the hearing industry reported the adoption rate using the economic model, it is fair to assume that United Healthcare would have been less likely to enter the market.

Clearly, use of the conventional adoption rate increases the influence of Internet sales and third-party distributors to enter the market. To lessen this effect and, more importantly, to provide a more accurate estimate of market penetration, the economic model is a salient option.

With respect to impacting the adoption rate, the service delivery model created by United Healthcare’s presence only amplifies the confusion as to the appropriate consumer entry-point for hearing healthcare. For many potential hearing aid users, the lack of clarity in the service delivery model only fosters the negative attitude and low expectation of hearing aids, which in turn, stagnates market growth.

Technology

Over the past 30 years, hearing aid technology has advanced from analog to digital, from linear to wide-dynamic-range-compression (WDRC), from single-channel to multichannel, from omnidirectional technology to directional technology having adaptive and null steering options—and the list goes on. Despite these advances in technology, marked increases in adoption rate are not evident.

One reason that technology has not increased the stagnant adoption rate stems from the fact that the market has failed and continues to fail at providing would-be users with evidence-based benefits of the technology in a meaningful way. In a recent study, Amlani and colleagues5 framed technology from the same hearing aid in three different ways: 1) Using vague, technical terms—such as “100% digital”—often seen in local and national newspaper and online advertisements; 2) Using detailed, technical terms, such as “memories,” “channels,” “adaptive directionality,” and “adaptive feedback control”; and 3) Using layman’s terms, such as “environmental listening programs,” “reduces background noise,” and “reduces whistling.”

Findings from this study (Figure 2) revealed that, when advertising utilized both vague and technical terms, listeners provided similar willingness-to-pay amounts for each individual technology. However, when the technology was framed using layman’s terms that demonstrated evidence-based benefit, respondents were willing to pay statistically more to obtain the same technology.

A post hoc analysis assessed the mean willingness-to-pay as a function of respondents’ experience with hearing aids. Specifically, inexperienced respondents who were shown technology described in layman’s terms that demonstrated evidence-based benefit were willing to pay more than their experienced counterparts for professional services (Figure 3). Experienced listeners, on the other hand, were willing to pay significantly more for technology—specifically for directional microphones—than their inexperienced counterparts.

Technology alone will not improve adoption rates. Improving adoption rates through technology is based, in part, on two factors. First, technology needs to be promoted in a manner that enhances user benefit, based on sound empirical evidence. Second, inexperienced hearing aid users are not technology driven, but rather, driven by the services they will receive related to the hearing aid fitting and rehabilitation process. Conversely, experienced listeners tend to be more technology driven, given that they have likely experienced the fitting and rehabilitation process previously.

Historical percentage values2 suggest that, as digital technology was introduced into the market in the mid-1990s, there has been impetus on the technological aspects of amplification technology, and not on rehabilitation. This impetus on technology is one reason that only 30% to 40% of hearing aid fittings are dispensed to first-time users over the past two decades.2

Retail Price

The high retail cost of hearing aids is often promoted as the primary deterrent to adoption of this technology. Data reported in various MarkeTrak surveys suggest that, while price is important, it is not the most important factor.

For example, data taken from MarkeTrak VI6 found that, while 85% of respondents desired lower retail prices, price was ranked fourth in importance behind the ability to hear speech against competing noise, improved sound quality and fidelity, and feedback reduction. In addition, MarkeTrak VIII7 queried respondents’ sensitivity of “value,” which is defined as the perceived performance for the price paid. For the variable of “value,” 16% of respondents renounced the price paid for the performance provided by the device, while 84% of respondents were mostly content with the price they paid and the technology they received. Had price been an issue—specifically buyer’s remorse—the percentage of unhappy respondents would have been much higher than 16%.

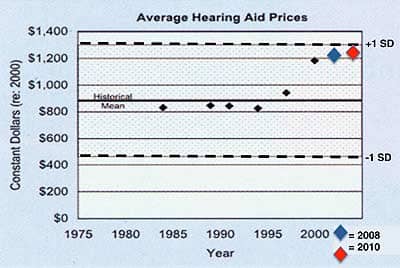

Figure 4. Average hearing aid prices over time. See text for details.

Figure 5. Retail price of hearing aids adjusted for inflation over time. See text for details.

Figure 6. Willingness-to-pay results by framing condition for the same hearing aid presented in a bundled and unbundled pricing strategy.

Figure 7. Willingness-to-pay results by hearing aid experience for the same hearing aid presented in a bundled and unbundled pricing format.

Another aspect of assessing the influence of price as a barrier to adoption is to compare today’s hearing aid retail cost to previous years’ retail costs. Figure 4, adopted from Lundeen,8 compares modern hearing aid price to historical values. Note that all hearing aid prices have been adjusted to represent constant dollars in the year 2000. The horizontal line labeled “Historical Mean” represents the average retail cost of hearing aids engineered with carbon, vacuum tube, and transistor technology between 1905 and 1961. The mean constant dollar price for these technologies is $882.

The shaded areas above and below Figure 4 represent the mean ±1 standard deviation. The black filled diamonds signify the average hearing aid prices determined in the MarkeTrak VI survey. The blue- and red-filled diamonds represent the average price of a hearing aid in 2008 and 2010, respectively, with prices also adjusted to constant dollars in the year 2000. Note that, although hearing aid prices in 1999, 2000, 2008, and 2010 were higher than the “historical mean,” each of the filled diamond symbols is still within the +1 standard deviation range. This data suggests that, while the price of hearing aids has increased over the past 50 years, the rate of increase is not significantly different compared to historical hearing aids.

Figure 5 represents the price of hearing aids over time, and is adopted from Doyle.9 In 1960, an analog BTE with a single-frequency response, omnidirectional microphone, and possibly a trim-pot or two retailed for $350. That same hearing aid, when adjusted for inflation, would cost slightly more than $2,500 in 2010, as indicated by the upward diagonal black and white bar. In 2010, a more technologically advanced hearing aid—denoted by the solid-black bar—retails for just over $1,900, or a savings of nearly $600 to the potential user. This finding suggests that contemporary hearing aids—which are far more technologically advanced than 1960s devices—cost less than a traditional device when adjusted for inflation.

Clearly, price is not the primary barrier to adoption. In fact, today’s hearing aids are technologically more advanced and cost statistically the same as in previous years, despite the rate at which inflation has increased.

Pricing Strategy

Is it possible that adoption rates have remained stagnant, in part, because of the prevailing use of the bundled pricing structure within the market? The answer is yes, according to a recent study.

In the study that was previously cited relative to technology,5 experienced and inexperienced users of amplification technology provided the retail price they were willing to pay as a function of whether pricing was bundled and unbundled for the same technology. As noted before, professional service was framed in three different ways (vague terms, industry terms, and layman’s terms). Figure 6 shows that, when the technology and professional service provided were presented in an unbundled format—regardless of how the technology and service were framed—consumers were willing to pay more compared when prices were unbundled. It is also worth noting that, when the technology and service to be provided were framed in a manner that supported evidence-based benefits, such as the ability to hear in the presence of background noise and reduced whistling, respondents were willing to pay more than when technology was framed using both vague and technical terms.

A post hoc analysis revealed that willingness-to-pay in a given price strategy was statistically influenced by experience with amplification. As seen in Figure 7, experienced hearing aid users were willing to pay the retail price of $1,531 for a hearing aid and professional fees presented in the bundled format, while inexperienced hearing aid users were willing to pay $327 less for the same product and service. Conversely, both experienced and inexperienced users were willing to pay a similar price for a device and professional fees framed using an unbundled strategy.

The latter finding is critical when one considers that the bundled approach creates a dichotomy between listeners based on experience. Specifically, experienced listeners were more sensitive to technological aspects, while inexperienced listeners were more sensitive to rehabilitative services. The use of an unbundled approach virtually eliminates this dichotomy.

What Does This Imply for Over-the-Counter Devices?

In order for the hearing aid market to grow, it must improve the demand function—or the behavioral relationship between quantity and a consumer’s maximum willingness-to-pay for incremental increases in quantity. The demand function within the hearing aid market is inelastic,1,3,10,11 which is directly correlated with adoption rate.3 The factor that has the greatest influence on improving demand function (ie, makes the inelastic market more elastic) and, ultimately, adoption rate is the availability of substitutes. At present, the hearing aid market has few substitutes, and those that are available are more invasive and restricted to a select population of hearing loss types. Examples of these substitutes include middle-ear implants, bone anchored devices, and cochlear implants.

An alternative substitution to improving the adoption rate is the introduction of over-the-counter (OTC) and direct-to-consumer (DTC) devices. If promoted and distributed correctly (admittedly, a big “if”), over-the-counter devices could reduce stigma, increase awareness of hearing healthcare, and improve adoption rates. Preliminary data from the University of North Texas suggest that OTC/DTC devices could potentially yield between 600,000 and 1 million units sold in the first year, with the likelihood of nearly 40% of these purchases leading to sales of more permanent amplification technology, based on the demand function of -0.38 through the fourth quarter of 2011.

Conclusion

The growth in adopting amplification technology is highly correlated with the data reporting of the industry and service delivery model of the profession. This model, unfortunately, is a primary reason for the stagnant growth recorded over the past several decades. If the industry and profession are to flourish, at least three changes are required:

- Improved accuracy in reporting adoption rates will limit the number of third-party distributors attempting to gain phantom market share, as well as limit confusion as to the need for professionals being the entry point of hearing healthcare.

- Promoting and providing rehabilitation services will increase the adoption rate of first-time users; promoting the evidence-based benefits of the technology in a meaningful way will increase the adoption rate of experienced users of amplification.

- The unbundled pricing approach needs to supplant the bundled pricing approach. Doing so appears to increase the retail price potential users are willing to pay, as well as limit the dichotomy in willingness-to-pay between experienced and inexperienced consumers of this technology.

Lastly, for the market to grow, at least some evidence exists that introducing hearing aid substitutes—such as OTC devices—is a worthwhile consideration. However, the manner in which the substitute product is promoted, distributed, and regulated is absolutely critical and must be carefully considered (ie, see the previous article by Jerry Northern, PhD).

Evolving and improving the way our profession does business will not only increase adoption rates, but also hearing aid satisfaction among our patients. Importantly, it also will keep the hearing care professional as the entry point to hearing healthcare.

Correspondence can be addressed to HR or Dr Amlani at:

References

- Amlani AM, De Silva DG. Effects of business cycles and FDA intervention on the hearing aid industry. Am J Audiol. 2005;14(1): 71-79.

- Kochkin S. MarkeTrak VIII: 25-year trends in the hearing health market. Hearing Review. 2009;16(11):12-31.

- Amlani AM. Will government subsidies increase the US hearing aid market penetration rate? Audiol Today. 2010;22(2):40-46.

- UnitedHealth Group. UnitedHealth Group business makes major breakthroughs in helping people assess, address hearing loss. October 3, 2011. Available at: tinyurl.com/bmgrtrm.

- Amlani AM, Taylor B, Weinberg T. Increasing hearing aid adoption rates through value-based advertising and price unbundling. Hearing Review. 2011;18(13):10-17.

- Kochkin S. MarkeTrak VI: Consumer rate improvements sought in hearing instruments. Hearing Review. 2002;9(11):18-22. Available at: tinyurl.com/czc9k3g

- Kochkin S. MarkeTrak VIII: Consumer satisfaction with hearing aids is slowly increasing. Hear Jour. 2010;63(1):19-27.

- Lundeen C. Hearing aid prices in historical context. Hearing Review. 2004;11(10):18-19. Available at: tinyurl.com/88vwqf2

- Doyle JB. How much is a hearing aid worth today? Hearing Instruments. 1980;31(9):26.

- Aaron MJ. An Economic Study of the United States Hearing Aid Industry: A Demand- and Supply-Side Examination. Doctoral dissertation. University of Illinois, Chicago; 1987.

- Lee K, Lotz P. Noise and silence in the hearing instrument industry. Working Paper, Department of Industrial Economics & Strategy. Copenhagen, Denmark: Copenhagen Business School; 1998.

Citation for this article:

Amlani A., Taylor B. Three Known Factors That Impede Hearing Aid Adoption Rates Hearing Review. 2012;19(05):28-37.