By Karl Strom, Editor in Chief

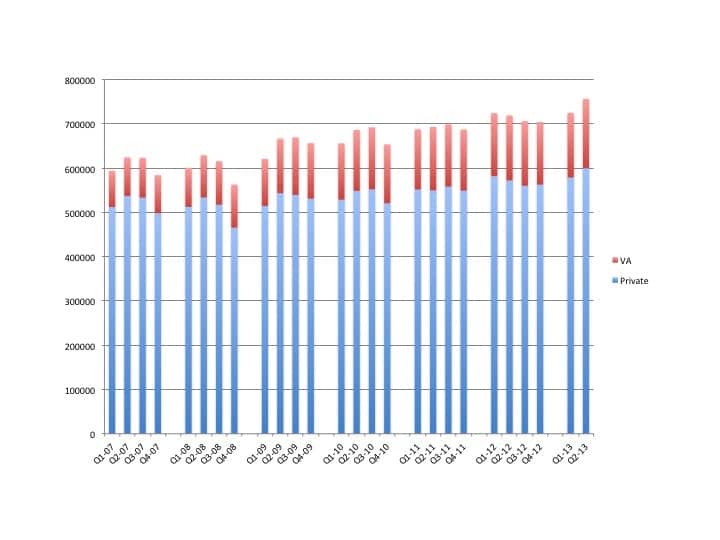

According to the Hearing Industries Association (HIA), Washington, DC, net unit hearing aid volume increased by 5.23% in the second quarter of 2013 compared to the same period last year, buoyed by relatively strong numbers from both the private sector (4.80%) and the Department of Veterans Affairs (6.92%). In total, sales are up by 2.65% in the first half of 2013 compared to 2012 (2.12% in the private sector; 4.79% in the VA).

The statistics offer at least some relief and contrast to a flat first quarter (Q1, a 0.10% gain) when private sector sales fell by 0.51% and VA sales rose by 2.59%. As pointed out in the May 2013 HR Staff Standpoint (p 6), sales from Q1 2012 were slightly better than average (a 5.3% gain compared to Q1 2011), thus probably making Q1 2013 sales appear gloomier than reality. This appears to be the case. The overall first-half sales increase of 2.6% is just shy of the industry’s historical 3-4% average.

BTE devices. BTEs constituted 72.95% of all hearing aid sales in the second half of 2013, up nearly 3 percentage points from 70.13% in H1 2012. In the private sector, BTEs made up 73.83% of all unit sales in the first half, while the VA used BTEs in 69.50% of fittings. BTEs with external receivers (RITE/RIC devices) now constitute over half (51.80%) of all private sector sales, while ITEs (26.17%) and traditional BTEs (22.03%) continue to decrease in usage.

Wireless devices. Wireless technology usage also continued to increase across all product categories and market segments in the first half of 2013, according to statistics that HIA began tracking this year. Overall, wireless hearing instruments accounted for nearly three-quarters (72.45%) of all devices dispensed in the H1 2013. A total of 81.78% of BTEs and 47.29% of ITEs offered wireless technology.

In the private sector, over two-thirds (67.30%) of all aids dispensed contained wireless technology, with about three-quarters (78.63%) of BTEs and one-third (35.33%) of ITEs being wireless. When looking at the private-sector BTEs, 83.90% of BTEs with external receivers (RITE/RICs) and 66.23% of traditional BTEs contained wireless technology.

Nearly all (92.52%) hearing aids dispensed by the VA in the H1 2013 were wireless, with 94.83% of BTEs and 87.26% of ITEs containing wireless technology.

RFC rates. Average returns for credit (RFC) are 2 to 3 percentage points higher than they were a few years ago. A total of 21.8% of all ITEs (24.2% wireless and 20.4% non-wireless) and 20.8% of BTEs (20.9% wireless and 20.3% non-wireless) were returned for credit during the second quarter. By comparison, in FY2010, the RFC rate was 18.7% for ITEs and 18.9% for BTEs.