Practice Management | August 2013 Hearing Review

By Ronald Gleitman, AuD

All hearing care practices deal with the same issues: running an office, buying and selling products, acquiring new patients, managing staff, continuing education, and marketing. With so many factors influencing revenue, is anyone surprised that annual revenue among these practices varies considerably in the United States?

However, success in these areas can help differentiate one practice from another. In this introduction to our planned series of analyses of survey results, we identify the top performing practices, defined here as practices with more than $1 million per year in gross annual revenue, and review what they appear to be doing differently that accounts for their success.

AOR Benchmark Practice Management Study

American Opinion Research (AOR) developed a practice management benchmark study based on responses to a national online survey conducted during September and October 2012. AOR received responses from hearing care professionals representing 215 practice locations throughout the United States.

- Approximately 90% of respondents identified themselves as being the sole decision-maker or playing a key role in the decision-making for the practice.

- Nearly 75% responded they were practice owners or co-owners.

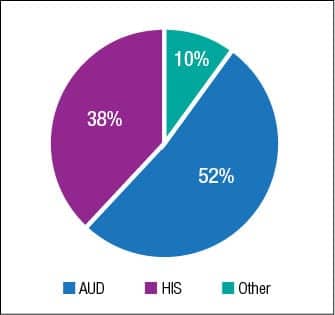

- The 215 practices included a mix of audiologists, hearing instrument specialists, and other professionals—all with varying degrees of work experience (Figure 1). The employees’ length of time at the current practice was: 2 years or less (12%); 3 to 5 years (19%); 6 to 10 years (17%); and 11 or more years (50%).

|

| Figure 1. Survey respondents. |

|

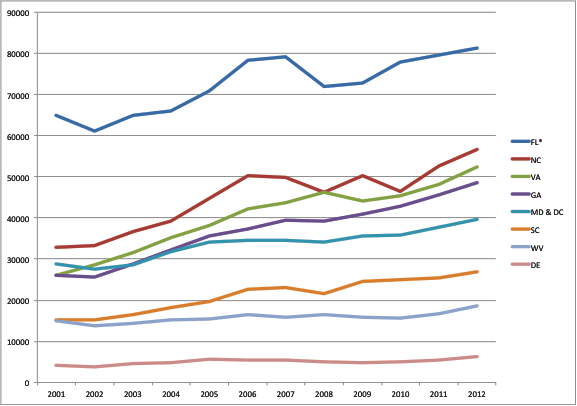

| Figure 2. Number of offices by practice type. |

We used the survey results to compare practices reporting gross revenue of $1 million or more (>$1M) in 2010 and/or in 2011 to practices reporting under $1 million (<$1M) during the same timeframe. The results provide insight into what one would consider best practices in clinical management. These best practices include tactics and strategies for employee productivity, product mix, management, staffing, marketing plans, and budgets. To further highlight this, we provide an example of the top performing >$1M practice in our results.

Results

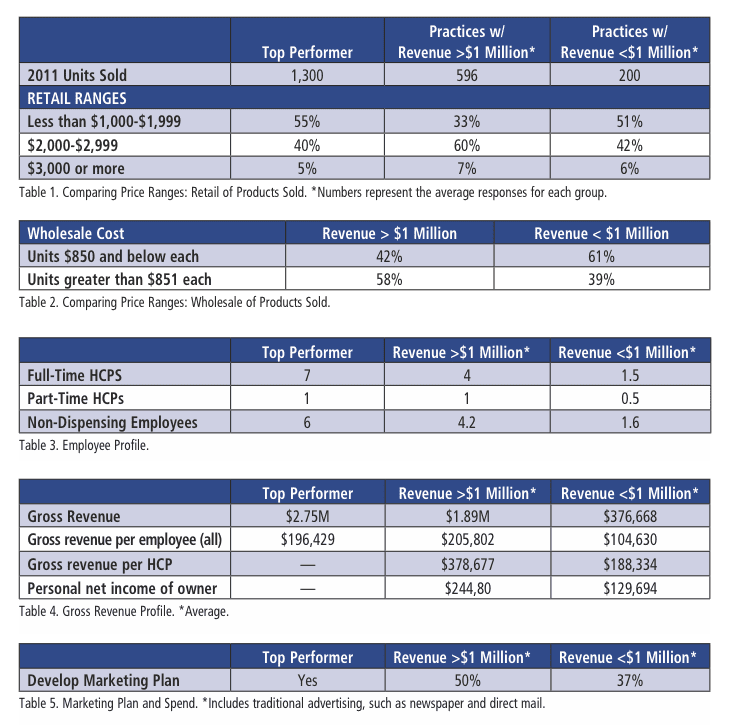

This AOR practice management benchmark study revealed that the 12% of all respondents in the >$1M category had several things in common (Table 1):

$1M+ practices sell more higher-performance hearing instruments. The data show a correlation between the higher performance level hearing instruments sold by the >$1M practices and increased revenue. The average units dispensed for all practices in this study was 251. However, the average number of units dispensed for >$1M practices was 596 compared to 200 units for practices with revenue below $1 million (this does not take into consideration the number of locations per practice).

|

| Tables 1 – 5 (click to enlarge) |

Practices that participated in the study sold on average:

- 57% RICs

- 22% BTEs

- 21% ITEs

Overall, Table 1 shows that the >$1M practices sold a higher percentage (60%) of hearing aids in the $2,000-$2,999 retail range than practices making <$1M (42%).

Currently, few practices have unbundled pricing for hearing instruments and services regardless of revenue. However, that seems to be changing, especially among the more successful practices. The >$1M practices are more likely to be considering unbundling (67%) in the future—more so than those with revenue under $1 million (42%).

It’s useful, therefore, to examine the wholesale cost of hearing instruments to get a better understanding of the technology level sold. Table 2 shows that the percentages are inverses of each other for wholesale cost. While the majority (58%) of hearing instruments for >$1M practices cost more than $850, a very similar percentage (61%) of hearing instruments for <$1M practices cost less than $850. As expected, this indicates the >$1M practices are buying and selling more high-end technology versus the <$1M practices. Based on a higher average retail price and even with a higher cost of goods, the practice with revenues above $1 million had a 10% higher gross profit.

Top practices employ more hearing care professionals and plan to hire in the next 3 years. Table 3 shows that practices with higher revenues employ more full-time hearing care professionals than the <$1M practices. The >$1M practices are more likely to have a patient care coordinator (93%) as compared with <$1M practices (72%). A greater percentage of higher-earning practices are also likely to have an office manager (43% versus 37%). Most (86%) of these practices have plans to expand their employee base versus 52% of <$1M practices.

Employees of top practices are more productive. The results in Table 4 show that employees of the >$1M practices were nearly twice as productive as the <$1M practices.

The hearing care professionals at these practices are also much more productive. The gross revenue per hearing care professional at >$1M practices ($378,677) is more than twice that of <$1M practices ($188,334). So, not only do these higher-revenue practices employ more HCPs, they also create an environment where HCPs are more efficient and productive.

Top practices have more than one practice location. Most >$1M practices have more than one location (Figure 2). Only two top-performing practices surveyed had one office. Results indicated that >$1M practices average $652,892 in gross revenue per office, while <$1M practices grossed $251,112 per office.

On average, >$1M practices spend over $90,000 on marketing. Marketing is very important. In fact, the top performing practice in the survey rates marketing planning as its #2 practice need and marketing implementation as #3. This top practice is aware of its marketing cost per appointment, and develops a marketing budget and program calendar prior to the start of each year. Only 26% of practices reporting revenue under $1 million knew the cost of acquiring new patients.

Marketing and revenue go hand-in-hand. As seen in Table 5, more successful $1M+ practices have a marketing plan than practices with less revenue (50% versus 37%). The survey also shows that the average marketing spend for >$1M practices is more than $90,000—nearly 3 times as much as <$1M practices. The cost per unit sold based on average marketing spend is $156 per unit for >$1M versus $166 for <$1M. With a binaural sales rate of over 90% for hearing aids, the >$1M spent $25 less per fitting than the <$1M practices.

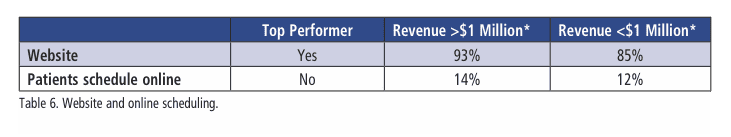

Top practices have websites. All but one of the >$1M practices has a website. Practices with revenues under $1 million are less likely to have a website than >$1M practices (Table 6).

According to Pew Institute research,1 Internet and social media use is continuing to grow rapidly among seniors age 65 and older, with a little more than half (53%) using the Internet or e-mail. Of those, 86% use e-mail, while 34% visit social media networking sites, such as Facebook.

|

| Table 6 (click to enlarge) |

|

| Table 7 (click to enlarge) |

Based on multiple data points revealed by this report and the Pew survey, practices planning to maintain or grow revenue should focus more on online marketing to keep up with the behavior of their target (and future) audience. Practices do expect online and Internet sales to grow, yet they have not adjusted their marketing budgets to reflect this. Marketing allocation for 2013 remains relatively unchanged, with most practices planning to increase Internet marketing only slightly. Although many other medical and healthcare disciplines have websites that allow patients to schedule appointments online, very few hearing care practices have websites that allow patients to schedule appointments. This may be an opportunity for all practices.

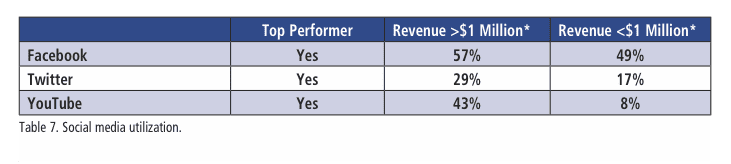

Top practices are more likely to have an expanded social media presence. More >$1M practices are utilizing social media outlets, particularly YouTube, Twitter, and Facebook (Table 7). Yet, only 49% of <$1M and 57% of >$1M practices have Facebook business pages.

About the #1 Top Earning Practice…

- The top performing practice in the survey achieved better results by fitting a very high volume of instruments (1,300 units)—more than twice the average of other >$1M+ practices.

- The top practice generated $2.75 million in revenue in FY2011. That same private practice was well on its way to exceeding these numbers in 2012, reporting revenue of $1.75 million in the first half.

- It sold mostly ITEs (70%), followed by RICs (25%) and BTEs (5%).

- The practice has 5 offices in the western half of the United States located in suburban and urban areas.

- 80% of its marketing budget is spent on traditional marketing and 20% online.

- This practice spends $30,000 annually to maintain its website.

- It employs 4 audiologists and 4 hearing instrument specialists. The remaining non-dispensing employees include 5 patient coordinators and 1 practice/office manager. It has both full- and part-time employees, and expects to hire in 2013.

- The difference in gross revenue between the top practice owner and other >$1M practices may be due to the heftier reinvestment of marketing dollars and other investments in the practice.

Summary of Survey Results

Using the results of the above survey, here are four important areas on which successful practices should focus:

1) Selling higher-performance level hearing instruments pays off. Practices with incomes of >$1M appear to be selling more advanced hearing aid technology. Even after considering the manufacturer price classes, this purchasing behavior is reflected in the survey. A 10% higher gross profit permits practices to employ strategies to grow their business, such as hiring more staff, aggressively marketing the practice, and providing better benefits to their staff. Practices with >$1M in revenue can pay their staff higher wages; for example, their practice managers make $29,000 more, on average, in compensation.

2) The right employee mix across multiple locations promotes productivity. Productivity per hearing care professional in >$1M practices far exceeds that of <$1M practices. The success of the top performing practices also supports the idea that having more offices equates to increased revenue over single locations.

3) Creating and executing a marketing plan are time and money well spent. Practices spending money on marketing plans intend to allocate marketing dollars in 2013 just as they did in earlier years, with the bulk going to newspaper and print advertising, and direct mail. There is a small increase in plans to use the Internet for marketing. Additionally, more of the >$1M practices are integrating social media in their marketing.

4) All practices should expand their online presence. While new patients continue to come in from referrals, newspaper ads, and direct mail, research outside this survey indicates that an expanded online presence should be beneficial to all practices. As more seniors turn to online resources for healthcare information, savvy practices should get ready to reach these consumers. Actions include:

- Creating more robust sites;

- Tracking responses to online campaigns by directing interested consumers to a special online site tied to a promotion;

- Managing social media sites;

- Optimizing sites; and

- Enabling online appointments and more.

Conclusion

Successful practices have consistent, diverse marketing and more productive employees. Hearing care practices that set up marketing plans, spend time and money on marketing, and embrace changes like online marketing are likelier to experience increased revenue. The winning formula is to plan and spend more on marketing, which can drive new and existing patients into the practice. This also increases employee productivity and permits the owner to reward and motivate all staff members.

The future of independent hearing care practices is excellent if owners employ a strategic plan to manage their businesses.

Those forward-thinking practices that adjust to how our patients access and acquire product/service information will be better positioned for future success. We believe the Internet and unbundled pricing are two business factors that will play an increasingly important role.

This survey provides a foundation to benchmark practices, and Siemens has engaged AOR to perform a follow-up study this fall.

|

Ronald Gleitman, PhD, is Vice President of Business Development & Practice Management at Siemens Hearing instruments Inc, Piscataway, NJ. CORRESPONDENCE can be addressed to Dr Gleitman at: [email protected] |

Reference

1. Pew Internet & American Life Project. Older adults and internet use [June 6, 2012]. Available at: http://www.pewinternet.org/Reports/2012/Older-adults-and-internet-use/Summary-of-findings.aspx