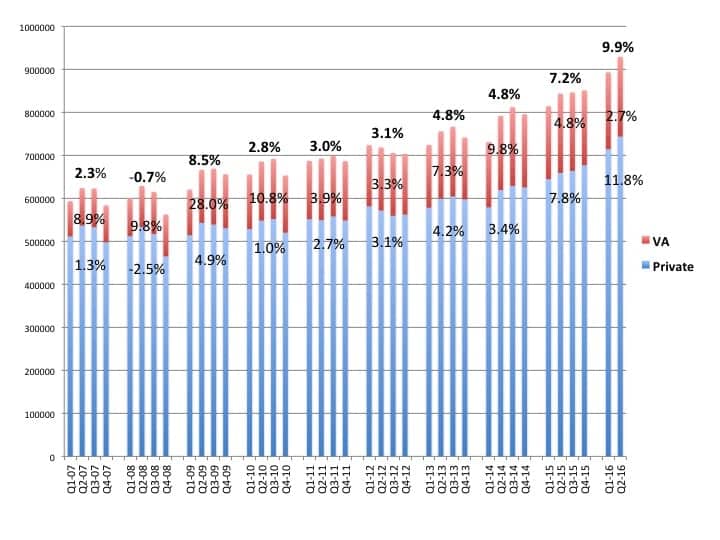

[Click on image to enlarge.] Hearing aid net unit sales by quarter, with VA dispensing in red and private/commercial-sector dispensing in blue. Sales in H1 2016 grew by 9.9% for the total market, 11.8% for the private sector, and 2.7% for the VA. Source: HIA.

When comparing the first-half (H1) figures of 2016 and 2015, the private sector this year has sold nearly 1.5 million units for an increase of 11.8%, while the VA has dispensed just over 360,000 units or 2.7% more hearing aids. In total, the hearing aid market has grown by 9.9% compared to H1 2015.

At the current pace, US hearing aid sales would approach 3.7 million units by year’s end.

It should be noted that unit volume sales of some Big Box retail (eg, Costco) outlets are included in the private sector sales, so the percentage increases reported here are not necessarily reflective of the typical traditional dispensing office. Additionally, there are two new reporting members in HIA, Hansaton and Intricon. Both are long-time players in the hearing industry and maintain US headquarters in Minneapolis. IntriCon Corp, a US public company, develops and supplies components and manufactures hearing aids for many medical device firms and hearing aid distributors, including their joint partnership with the Academy of Doctors of Audiology (ADA) and EarVenture and United Healthcare’s Hi HealthInnovations. Hansaton, a part of Hansaton Akustik GmbH, was founded in Germany in 1957 by Rudolf Fischer, and was purchased by Sonova in 2015. In more recent years, it has become known for its rechargeable hearing aid technology and its Surround SoundHD, Beat, and jamHD lines of hearing aids.

The new reporting members are unlikely to account for a large portion of the growth seen in the first half. However, as with last year’s unit growth of 7.2%, it is uncertain how much Costco and other Big Box retailers are contributing to these growth figures.

Comparing first-half 2016 statistics with those of 2015, the use of behind-the-ear hearing aids (BTE) has increased by 1% overall and 2% in the private sector. BTEs accounted for 80.8% of all the aids dispensed in the United States in Q2 2016, and constituted 82.0% of all private-market sales. Last year at this time, BTEs made up 78.9% of the total market and 80.0% of private-sector sales. The VA saw sales increase from 74.9% to 75.8% during this same period.

The growth of wireless hearing aid features also continues. In the first-half of 2016, about 9 of 10 (87.5%) hearing aids sold contained wireless technology, according to the HIA statistics.

Dear all:

My firm, Nathan Associates Inc., is assessing the trade impact of the 3D printing for the World Bank. We want to use hearing aids as a short case study within the report and how the adoption of 3D printing for manufacturing has impacted the supply chain/distribution dimension for the industry. Can you suggest a source or contact we may refer to to get a better grasp as to how supply chains/distribution have been impacted? Any help you can provide is greatly appreciated.

In 2012-13, Ian Windmill and I presented and published demographic data that predicted this growth in the hearing aid market beginning in 2016. Baby boomers may have begun turning 65 in 2011 but the average age people first purchase hearing aids is 70 years (MarkeTrak) which is 2016. The baby boomers are now beginning to enter the market for hearing care and this trend should continue for at least another decade.

Barry Freeman

I agree. The demographics of the hearing healthcare market are pretty daunting and undeniable. In fact, your earlier Audiology Today article about the “Crisis in Audiology” (2009?)–mathematically showing why there aren’t enough professionals entering the field–was a sobering wake-up call for the profession, in my opinion.

I saw your comment about obtaining historical statistics. Is it possible to get the actual data if you are not an HIA member?

You would have to contact HIA for that. Their website is http://www.hearing.org and their phone number is 202-449-1090.

Hi,

Where can I find the statistics that you refer to: Hearing Industries Association (HIA)?

The statistics are provided by the Hearing Industries Assn to its members. For more information, visit http://www.hearing.org. Thanks.

Where can I find the data you refer to?