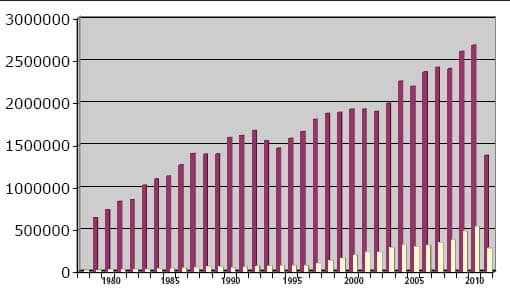

Despite what might be perceived as a constant flow of grim economic news and financial indicators, US hearing instrument sales in the second quarter (Q2) of 2011 were stable and comparable to the same period last year, according to statistics compiled by the Hearing Industries Association (HIA). Overall net unit sales were 1.0% above 2010 Q2 sales, with private sector sales remaining unchanged (-0.06%) and the Department of Veterans Affairs (VA) experiencing a 5.3% unit increase. This compares to a 5.0% sales increase during the first quarter (4.4% and 7.6% increases for the private sector and VA, respectively). Thus, total sales for the first half (January through June) increased 3% compared to 2010 (2.1% and 6.4%, respectively)—amounting to about 40,000 more hearing aids sold.

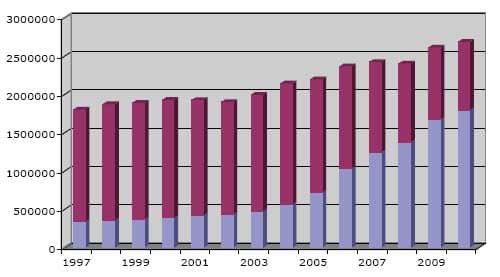

Both the private sector and the VA continue to rely more on behind-the-ear (BTE) technology, with 69.7% of all hearing aid fittings involving BTEs in the first half of 2011. BTEs accounted for 70.6% of all the hearing aids dispensed in the private sector, with 44.8% of those BTEs featuring external receivers (eg, RICs and RITEs). Notably, unit sales of these external-receiver BTEs exceeded those of in-the-ear (ITE) hearing aids for the third consecutive quarter in the private sector.

Total US hearing aid net unit sales (VA and private sector) in red, with VA units in yellow as a reference (1979 to H1 2011). Source: HIA.

Total US net unit sales (VA and private sector, 1997-2010) by instrument type, with in-the-ear hearing aids in red and BTE hearing aids in blue.

There are mixed signs regarding average selling prices (ASPs) for hearing aids in the United States. In informal polling of dispensers by HR, there appears to be a slight movement by consumers to the mid-line products at the expense of the premium segment; however, recent online dispenser surveys showed that, at least in the last 6 months, virtually no change in overall ASPs occurred.

Things appear to be about the same when looking at the worldwide market, with hearing instrument sales growing by about 4% in the first half—which is on the high end of the often-cited 2% to 4% long-term industry growth rate—and ASPs static or slightly decreased due to the renegotiation of some large public contracts (most notably England’s NHS).

Although US second-quarter sales growth (1%) was not as robust as the first quarter (5%), the data suggests a resilient and relatively healthy market for hearing aid sales—amidst economic reports (and disconcerting 401k balances) that turn your hair gray.

Karl Strom

Editor-In-Chief