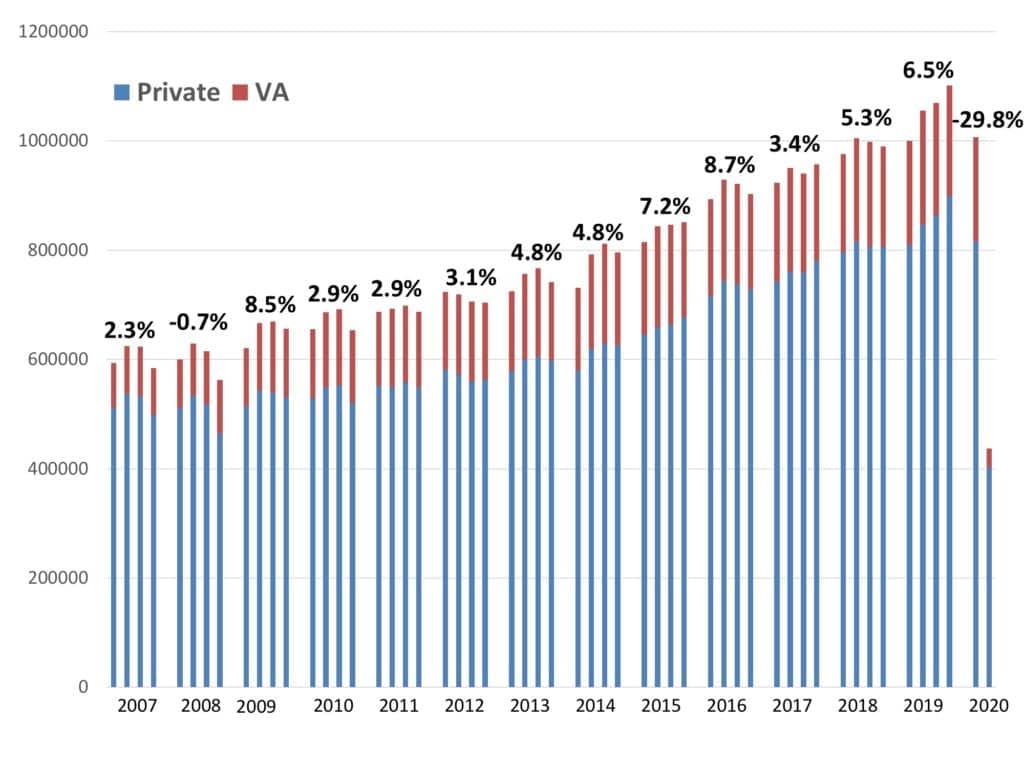

According to statistics generated by the Hearing Industries Association (HIA), Washington, DC, hearing aid net unit sales in the United States decreased by 58.6% in the second quarter of 2020 due to the negative effects and mass shutdowns caused by the Covid-19 pandemic beginning in March. Unit sales for the commercial/private sector decreased by 52.5% in the second quarter, while the Department of Veterans Affairs (VA) dispensing activity decreased by 83.4%.

In total, for the first-half of the year, US hearing aid unit sales have fallen by 29.8%, with a 26.4% decrease in the commercial sector and a 43.5% decrease in VA dispensing. Due to its special population and the structure of its care facilities, the VA has been particularly cautious in seeing patients needing hearing aids. The VA—which traditionally accounts for about 20% of all hearing aids dispensed in the United States—made up less than 16% of units in the first quarter and only 8% in the second quarter.

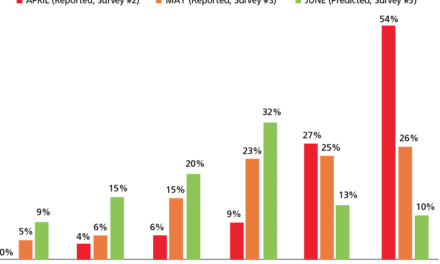

When looking at the entire first half of this ghastly year, the hearing aid unit sales statistics are actually buttressed, in part, by an extremely strong start in January and February— sales that were probably in the range of a 15% increase over the same period in 2019—as well as a surprisingly strong recovery for the commercial market in June. To review, on March 18, the CDC warned people ages 60+ not to engage in non-essential medical care due to Covid19, and by that time state and local governments were already closing schools, restaurants, and advising citizens to begin “social distancing.” Hearing Review’s Covid-19 Impact Survey #1, conducted between March 19-24, showed that many practices were shutting their doors, and subsequent unit sales for the month probably fell by about 25% in March. April was the cruelest month. The HR Covid-19 Impact Survey #2, conducted from April 9-17, showed that fewer than one-third of private and retail practices were physically seeing patients, and unit sales plunged somewhere in the range of -85%. By May, however, three-quarters (74.8%) of respondents to the Covid-19 Impact Survey #3 said they were physically seeing patients, with an even split between those offices observing regular operational hours (38.2%) and those with scaled back or reduced staffing (36.6%). Importantly, fewer than 5% predicted they would be closed in June. Unit sales for May were probably in the -60% range, but recovered (in relative terms) strongly in June with a -20% unit sales loss (but probably better than -10% for the private sector) compared to June 2019. However, as previously noted, the VA has taken a much slower approach to reopening services for people with hearing loss, with Bernstein reporting VA volume still down by 64% in June.

With July at its halfway point, it would appear that nearly all commercial hearing care offices are open and physically attending to patients. Sales appear to be somewhat variable, depending on the region, but have been steadily improving overall. With over 35 states now reporting increases in cases of Covid-19 and the unsettling fact that the pandemic will be with us for months or possibly years to come, the issue of hearing healthcare (or dentistry and other allied healthcare professions) being an essential service is no longer practically debatable; clinics and practices are moving forward serving patients and dispensing hearing aids with enhanced infection control and limiting patient contact with staff during procedures via teleaudiology when possible.

Karl Strom is editor in chief of The Hearing Review and has been reporting on hearing healthcare issues for over 25 years.

The HIA needs to get its lazy bones moving with heavy duty advertising. They cannot expect more sales and raking in profits without working for it!