One of the first articles that I wrote in HR almost 17 years ago was a wide-eyed examination of the aging population as it relates to hearing aid sales (“Catch a Wave!” April 1994 HR). Today, through the eyes of a crusty editor, I have to admit that my near-breathless description of an impending flood of Baby Boomers into the hearing care market was…well…a bit premature.

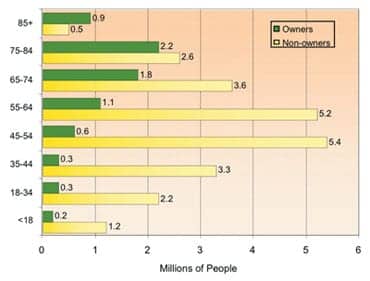

Baby Boomers haven’t flooded into hearing care offices—despite millions of R&D dollars spent by manufacturers and what could only be viewed in 1994 as futuristic capabilities, like today’s tiny CICs, digital programming, instant- and open-fittings, and wireless devices. It’s obvious that our industry has been seeking ways to appeal to younger users, and for a very good reason: that’s where the largest number of potential hearing aid owners reside (Figure 1). MarkeTrak VIII (October 2009 HR) shows that the hearing loss population is growing at the rate of 160% (1.6 times) of US population growth due to the aging of America. Unfortunately, the same data also show that the first-time user profile is virtually unchanged since time immemorial: on average, hearing aids are purchased by 70-year-old people, and the average life expectancy of a US citizen is 78.3 years.

FIGURE 1. Hearing loss population in 2004 by age: hearing instrument owners (green bars) versus non-owners who have a significant hearing loss (yellow bars). Source: Sergei Kochkin, MarkeTrak VII, July 2005 HR.

FIGURE 2. Follow the bulges. Age group population comparisons (2000 vs 2010) for six states (clockwise: NY, Ohio, Fla, Ore, Calif, Mich). Blue are maies, yellow females, and the dark line marks the age 65+ population.

But Baby Boomers are getting older. A look at age pyramids by state shows subtle but important differences during the past decade (Figure 2). A time-lapse film of each pyramid would resemble a tube of toothpaste being gently squeezed two-thirds of the way down the tube—more people are squirting into the higher age brackets. So, in demographic terms, it doesn’t matter if the industry succeeds in appealing to younger users; the Boomers are coming anyway. In time.

Of course, huge rewards remain for appealing to younger users. In 2009, I conducted a podcast interview with Louise Hickson, PhD, who had moderated a fascinating conference that focused, in part, on hearing and cognition in older adults (www.hearingreview.com/podcast/files/ST20091210.asp). Some incredible studies that link hearing loss with dementia have surfaced (see last month’s Beck & Flexer HR article and the February Archives of Neurology paper covered in HR‘s online news at www.hearingreview.com/insider/2011-02-17_09.asp). I asked Dr Hickson where she thought—given all the data on the importance of hearing for cognitive status—this research might provide the largest dividends for seniors. Her answer: we need to find some way to shorten the time that the average person takes in seeking hearing help from about 10 years to 5 years. Amen.

This edition of HR has several articles that reflect the market’s response to Baby Boomers, including Internet marketing (see HROnline News), wireless systems, wideband devices, instant-fit CICs, and client-driven fine-tuning methods, all of which appeal to Boomers’ lifestyles, proclivities, and needs—or demands. Can our industry reduce the average age of first-time hearing aid users? The stakes are so high, it’s hard to believe it won’t happen. In time.

Karl Strom

Editor-In-Chief