Business Management | May 2020 Hearing Review

By Brian Taylor, AuD

As Winston Churchill said, “If you’re going through hell, keep going.” We have no choice but to forge ahead, together, through this pandemic. This is an especially perilous time for our many of our patients—adults over the age of 70.

The most prudent course of action, of course, is carefully following your state and local guidelines with respect to operation of your business. Additionally, professional organizations are an essential source of information. For example, the American Academy of Audiology (AAA) has an abundance of clinical guidance on practicing through this Covid-19 pandemic at this link.

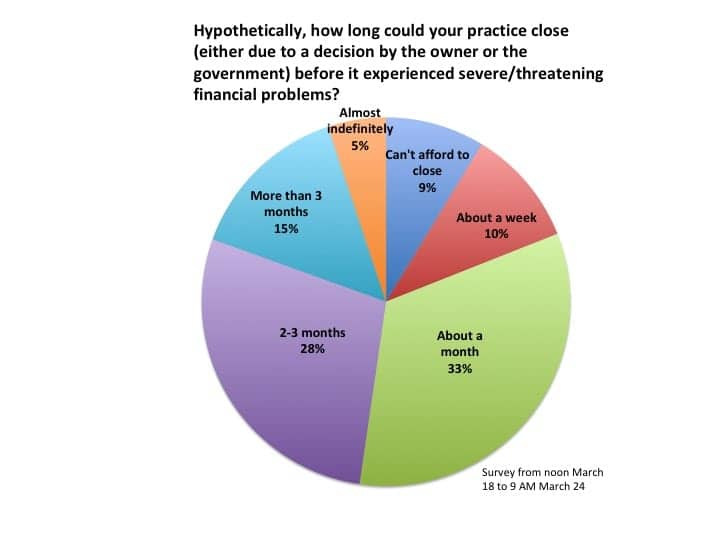

And, since the Covid-19 pandemic is expected to be a protracted event with significant consequences on the national economy, it will have a profound effect on all clinics, but especially smaller practices that rely on those 20 or so hearing aid sales each month to sustain their business. A 2016 JP Morgan analysis showed that only about half of all small businesses hold a cash buffer large enough to support 27 days of their typical outflows. A recent post by Hearing Review suggests this figure is relatively the same for the typical hearing healthcare practice (Figure 1).

Cash Flow and Your Practice

Work with your partners. Over the next month or two, cash flow is likely to be the biggest challenge for many practices. Given the importance of cash flow, all practices should immediately develop a plan for cash management as part of an overall business risk and stability plan. Besides closely following the activity of the Federal Reserve, it’s imperative to work with your preferred hearing aid manufacturing and buying group partners (both have financial specialists on staff) in creating a cash flow plan.

Emergency loans and state/federal government support. The US Small Business Association’s website also should be monitored daily for any updates on emergency loans and grants. Additionally, many states have emergency loan programs for small businesses and—given that current federal interest rate is around 1%—be sure your state is offering an interest rate that is comparable to the feds current rate. There are also several bills steaming through Congress that may provide relief.

In addition to finding new sources for an infusion of short-term cash, here are a couple other considerations over the immediate 30 to 90 days:

Think Like a CFO. Look for ways to reduce variable costs. For example, if you can avoid stocking up on any items you keep in inventory, that helps shave some dollars off monthly expenses. Other ideas to lower monthly expenses include, negotiating longer payment terms with vendors. Hold off on any large fixed expenses, such as buying new equipment, pay raises or hiring a new person.

Ramp Up Telehealth. All major hearing aid manufacturers provide remote tuning and virtual office visits through their latest fitting software. Contact your manufacturing partner for guidance on what your practice and your patients need to get started with the use of remote tuning. Now is the time to jump on the telehealth bandwagon by encouraging as many patients as possible to use this service for hearing aid fine tunings and quick virtual face-to-face checkups.

For many of us, this is the first time we’ve lived through such a black swan event with so much uncertainty. Let’s take some comfort in the fact that we are all in this together; our collective continuous effort and support will help us weather the storm.

About the author: Brian Taylor, AuD, has more than 25 years of experience in hearing healthcare and is Director of Scientific & Product Marketing at Signia, Piscataway, NJ.

Citation for this article: Taylor B. Plan for the worst, hope for the best: Strategies for cash-flow difficulties and Covid-19. Hearing Review. 2020;27(5):17.

Image: © Windsteel | Dreamstime.com