The year 2005 brought the hearing health care field mostly positive news in the form of new advanced technology, research findings, and legislative action. However, 2005 hearing instrument sales were not as robust as what might have been hoped, and will probably come nowhere close to last year’s 7.5% increase in sales. Using Hearing Industries Association (HIA) figures,1 HR estimates that about 2.19 million hearing aids will have been dispensed by the end of 2005—or about 2% more than the previous year.

The following is an attempt to identify only a few of the major trends sweeping the industry that have the potential to seriously impact hearing instrument dispensing. The first section, “Ten Trends Witnessed in 2005,” looks at factors already established during the last couple years. The second section is far more speculative, offering an analysis of likely trends in 2006 and beyond.

Ten Trends Witnessed in 2005

1 Open fit hearing aids. Take one look at the “Looking Back; Moving Forward” section that follows this article, and you’ll see many, many new open-fit devices that were launched in 2005. Open fittings are designed to allow more natural sounding signals without occlusion, eliminate the requirement of impressions, and also provide an “instant fit” so the wearer can walk out of the office with the hearing aid the same day he/she has the appointment. It is also hoped—although certainly not proven—that these aids will appeal to a younger clientele.

2 Directional technology. Directional technology has been a key focus of hearing instrument manufacturing during the last 4 years, and MarkeTrak VII2 suggests that a quarter (25%) of all newer hearing aids (<5 years old) are directional, while the HR Dispenser Survey suggests that the number is closer to one-third (36%).3 The percentages, however, are clearly growing.

Directional microphones arguably remain the only proven method to improve the signal-to-noise ratio in noisy environments (Sonic Innovations has shown that noise-reduction algorithms are another method).4 In particular, adaptive directional systems have received a lot of attention in the literature during the last year.5,6 As mentioned in a number of recent HR articles,9,10 it is likely that directional mics will someday be “standard” on any hearing aid large enough to accommodate them.

3 A BTE Renaissance. Trend 1 + Trend 2 = Trend 3. Behind-the-ear (BTE) hearing instruments have made substantial market gains during the last 3 years, driven by open-fit technology, the arguable fact that behind-the-ear (BTE) aids provide more options when using directional mics, and that new hearing systems like the Sebotek PAC and over-the-ear aids are also counted as “BTEs.” According to Hearing Industries Assn (HIA) statistics,1 BTEs made up 33.5% of all units dispensed in the US during the third quarter. In contrast, they constituted 26.4% of the market in 2004 and only 20.2% in 2000. For an industry that has seen nominal changes in terms of style changes since 1994 (when CICs became widely available), this represents a significant change in dispensing behavior.

4 Wireless amplification and hearing testing technology. We are rapidly becoming a wireless world. Our computers and cell phones will continue to become untethered from cables and wires, while everything else we own will become tethered to our computers and cell phones. However, it’s possible that “personal hearing systems”—whether they be iPods, headsets, or hearing aids—will join computers and phones as a vital link to the rest of our electronic world. In the last couple years, the hearing care field has witnessed product introductions like the wireless Lexis FM system,11 Unitron WiFi Mic,12 and Siemens Acuris,13 as well as Bluetooth wireless technology like the GN Otometrics Otoflex,14 Phonak SmartLink SX,14,15 Gennum GenBlue technology, HIMSA NOAHLink,14 and the Starkey Group’s ELI,16 to name only a few. In the long march toward “total communication devices”—whatever these devices will ultimately look like and do—today’s wireless hearing devices may represent prototypes of these systems.

Additionally, multiple-utility wireless devices are just plain “cool” in the eyes of the consumer, a fact that can only help overcome age-old stigma issues.

5 The Hearing Aid Tax Credit. The US government is currently experiencing serious debt, and it may be difficult to persuade members of Congress and government bean-counters in 2006 that a tax credit would ultimately improve the nation’s fiscal and physical health.10 Currently, there are 84 bipartisan co-sponsors to the Hearing Aid Tax Credit Bill (HR414 and S1060), which would provide a $500 tax break per hearing aid for individuals over age 65 or under 18, renewable every five years. What would this do for the hearing care market? The best guess is that a 25% reduction in the price of hearing aids would result in about 15% greater use of the devices.10

Virtually every hearing-related organization endorses HR414 and S1060. The Hearing Aid Tax Credit Bill and universal newborn hearing screening (UNHS) are perhaps the only two issues in the field that every professional in every discipline can rally around.

6 Better technology at more attractive price points. The digital hearing instrument market has come of age, consuming 88.6% of all the aids sold during the first three quarters of 2005. There is now a relatively well-defined “good, better, best” stratification for digital aids. For example, according to the HR Dispenser Survey,3 the average sales price (ASP) of a digital instrument was $2066, but this price differed by about $900-$1100 depending on whether the device was from a premium, mid-level, or economy level product line. This price choice grows wider, as digital aids continue to exert pressure on and push into the analog segment (Figure 1). Further, digital prices decreased by 4.3% in 2004.3

Figure 1. Average price of hearing aids in late 2003 by technology type and style of hearing aid (BTE, ITE, canal, and CIC). Average prices offered by all dispensing professionals for analog non-programmable aids ranged from $916-$1339, analog programmable from $1157-$1603, and digital from $1302-$3040, with ITEs and BTEs generally being the least expensive, and ITCs and CICs commanding greater prices due to the fitting/servicing issues surrounding them. Although price segmentation between the premium, mid and economy level DSP categories are probably not as clear-cut as shown here, it’s likely that dispensing professionals have benefitted from a distinct good (eg, analog non-programmable aids), better (programmable analog), and best (digital) system of technology offerings. One can also see in this graph how the programmable analog segment is getting “squeezed” severely by the analog and DSP segments. *Note: Prices include, for the most part, audiological testing, fitting, and service fees.

What this demonstrates is that consumers have greater choices in terms of price and quality technology, and this may have even contributed to the slight rise in first-time users reported by both MarkeTrak VII (32% in 2000 vs 39% in 2004)2 and the HR Dispenser Survey (43% in 2003 vs 49% in 2004)3 Likewise, some industry insiders speculate that the upturn in private sector unit sales during the last 3 years is because professionals must now dispense more devices in order to make up for stagnant and/or lower digital ASPs.

7 Mostly positive press and solid research findings that are supportive of hearing health care. It’s easy to forget that only a decade ago, in the mid-90s, there were rancorous inter-professional feuds making their way into the press: 60 Minutes was airing gotcha-exposes featuring shady dispensers, and FDA Commissioner Kessler was using the hearing industry as a punching bag. So maybe a better description of this category is “A Welcomed Absence of Horror Stories.” Whatever the description, hearing health care has enjoyed a period of steady, informative, positive publicity in the mainstream press, as well as within scientific and medical journals. Notable examples include Yoshinaga-Itano’s groundbreaking data on the value of early identification of hearing loss,17 the National Council on the Aging’s (NCOA) quality-of-life study,18 the VA study on hearing aid performance,19 Yeuh et al’s JAMA article on the need for physician screening for hearing loss,20 and the BHI’s recent study on the relationship of hearing loss and income.21

8 Corporate network & HIS gains. Amplifon has an aggressive goal of gaining $100 million in business during the three years from 2004-2006. Sonus purchased 155 dispensing offices/practices in the last year alone, including the Hear for Life chain (see Sept HR News, p 14). Beltone and Audibel have also made notable gains during the last 3 years. Additionally, the larger retail networks have made admirable efforts designed to improve their quality control and dispensing standards.22

MarkeTrak VII statistics also suggest that, relative to the percentage of units dispensed, a shift may be occurring in favor of hearing instrument specialists (but not necessarily those employed by corporate chains). However, Kochkin noted in a recent interview that—when taken across the wide variability of services encountered throughout the US—most consumers do not understand the difference between an “audiologist” and a “hearing aid dispenser.”10 It might also be noted that more than 20% of all offices employ both.3

9 New-generation AR programs. Aural Rehabilitation (AR) remains one of the biggest stumbling blocks to high levels of customer satisfaction with hearing instruments. Kochkin noted in MarkeTrak VI23 that consumers who receive more than the modal half-hour of instruction and counseling for their hearing aids, on average, report customer satisfaction rates that are 10-20% higher. He also points out that this instruction can take virtually any form: a trained staff member explaining aided hearing strategies, a hearing-related consumer book or video, etc.

Robert Sweetow, PhD, of UCSF, and colleagues introduced the LACE system in 2005.24 Characterized as “physical therapy for the ears,” the computer program is designed to enhance a person’s listening abilities with (or even without) a hearing aid by getting the patient involved in his/her AR plan. This may be the first of a new generation of AR programs that, at their core, seek to engage the patient in his/her own AR. Similarly, devices like the Oticon Sound Activity Meter (SAM)25 show promise for assessing patients’ real-world listening situations and involving the patient—almost from the minute they step into the office.

10 Sound simulators. As with “new-generation AR programs,” in-office sound simulations designed to replicate real-world acoustic environments will continue to play a greater role in the hearing aid fitting process.26-28 These types of systems may be used to engage the patient and show them the benefits of advanced hearing aid technology, as well as trouble-shoot during the readjustment process.

Ten Things to Watch

1 e-Business and e-Impressions. Dispensing professionals’ reliance on the Internet to communicate with suppliers will become much greater in 2006-2008. One reason for this is the advent of eTONA,29 and the other reason is the new technology being developed to scan and render impressions.30,31 Many of the major manufacturers are working on an in-office technology, and Siemens already has its iScan system in some offices. Whether you scan impressions in your office, or send them to a manufacturer/lab for scanning, one thing appears certain: More impressions will be kept on electronic file, and more orders will be sent via the Internet. Files will be available longer and will be manipulated on the computer screen prior to shell manufacturing/modification. Similarly, ordering will be done via online forms designed to minimize and/or catch mistakes, speed processing, and orders will be tracked on one screen for better efficiency.29

2 Wiser algorithms. If you accept the premise that, for most hearing aids, “Noise Reduction/Comfort” algorithms translate into “better comfort in noise” and “Directional/Adaptive Directional” algorithms mean “better hearing in noise,” then it seems likely that acoustic scientists and engineers will continue to make incremental gains in both these areas. One example is the challenge of reducing the effects of reverberation in places like concert and lecture halls, places of worship, etc. Fabry and Tchors32 and Schweitzer and Smith33 have described hearing systems designed to do this. Another example might be a voice recognition system that can be “tuned” to the voice of a spouse, making his/her speech pop out of the background noise (Personal communication with Steve Walsh, Chicago). Whatever the functions, the production of smarter algorithms will probably always remain a primary R&D and product innovation avenue.

3 Binaural integration of signals. Although the ACURIS uses information from the two hearing aids,13 even Siemens admits that this is only the beginning for this promising new binaural technology class. We will soon see hearing devices that gather wirelessly transmitted data from both sides of the head (and possibly other external microphones), and use these additional acoustic cues for complex processing (eg, head-shadow effect) and enhanced listening in noise.

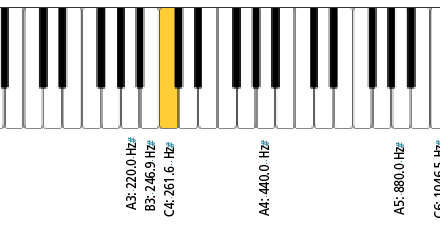

4 Hearing aids with a wider frequency response and better fidelity. Somewhere Mead Killion is smiling. He has maintained that higher fidelity—frequency responses out to 12-16 kHz or more—promotes intelligibility, and that hearing-impaired listeners are surprisingly good judges of fidelity.34 In fact, Killion’s 1979 doctoral dissertation was on this very topic, and he insists that the success of the K-Amp and DigiK was, in part, related to fidelity issues. Hearing instrument fitting and testing in the extended high-frequencies—and true high-fidelity hearing aids—will be more common. And this movement will also bring with it some possible extra “bonuses,” like ototoxicity monitoring and enhanced tinnitus management capacities.

5 Industry Consolidation, Part 3. In 2005, GN purchased Interton, and Sonic Innovations purchased Tympany. Are we on the brink of a third wave of consolidation?

The industry has experienced two periods of consolidation during the last 8 years. The first period, from 1998-2000, witnessed larger companies purchasing smaller ones. For example, Starkey acquired Qualitone and Micro-Tech; William Demant acquired Bernafon and Interacoustics; Amplifon purchased Miracle Ear; Phonak acquired the Unitron/Argosy/Lori Medical group; and GN purchased ReSound, Philips Hearing Instruments, and Beltone. A second period of “forward-consolidation” from 2000-2002 involved manufacturers purchasing distribution capabilities. For example, the Audibel and AVADA groups were formed; Phonak acquired the Austrian company Hansaton; Siemens entered into agreements with HEARx; Helix and HEARx merged; ReSound entered into agreements with Sonus; and William Demant purchased 49% of American Hearing Aid Associates. The point is that there was a frenzy of purchasing activity, and it was something like a game of musical chairs: No one wanted to be alone without a chair when the music stopped.

Most industry experts agree that consolidation is far from over in the hearing industry. “In my opinion,” said Oticon CEO Niels Jacobsen in a 2004 interview with HR, “the resources that companies need to spend on R&D will continue to grow rapidly. And the only way to really justify these expenditures is by gains in volume and market share.”32 In other words, it appears that further consolidation is inevitable.

6 Demographics of hearing loss. The number of people with significant hearing loss in the US is now 31.5 million, according to MarkeTrak VII.2 Since 2000, the hearing-impaired population grew by 9.9% compared to a household population growth of 6.8%. It is projected to increase to 33.4 million by 2010 and to 38.4 million by 2020.

However, the real potential for growth in the industry is in getting younger (read Baby Boomers) to take action on their hearing loss at an earlier age than their parents. Unfortunately, the average age of adoption of new hearing aid owners increased from 66.3 years old in 2000 to 69.7 years old in 2004. Additionally, the average household income of new purchasers has risen from $46,300 to $55,800 in the same period.2

Hearing loss isn’t confined to the Northern and Western Hemispheres. Improving economic conditions in markets outside the US and Europe will present significant opportunities for the hearing industry. Eastern Europe and Russia, Central and South America, India and China are areas in which the hearing industry is keenly interested.

7 Personnel shortage. In contrast to the above information, as well as HR statistics and reports from the field, the number of full-time dispensing offices in the US has remained static in recent years. Many within the hearing industry privately complain that one of their biggest problems is finding enough qualified dispensing professionals to fill vacancies left by retiring audiologists/dispensers. Those dispensing professionals who opt for retirement often find themselves in a buyer’s market; some sell only their files and close their office, while others sell to the chain networks which have become something of a clearinghouse for office transactions. The American Academy of Audiology (AAA) has expressed concerns that there are not enough PhD research audiologists entering the field. In short, it appears that the hearing care field needs to seriously consider how to attract more people to the profession.

8 Remote programming of hearing instruments and consumer-driven adjustments. The ability to connect a hearing aid to a computer interface box, then have the hearing aid parameters readjusted online is currently feasible. But the “devil is in the details”: The questions revolve around who will adjust the aid and how it will be adjusted, as well as how much user-control might exist for the hearing aid owner without the serious threat of botching the fitting or endangering the patient’s residual hearing. Is it possible to identify those consumers who can effectively self-adjust certain hearing aid parameters, versus those who cannot? There are also some thorny professional concerns that could arise. But experience suggests that, if a promising technology exists, someone will eventually employ that technology.

9 Binaural Market Saturation. Gone are the days when hearing industry growth was linked to the fact that more consumers were purchasing two aids, as opposed to only one. Much of the rapid unit growth during the late-1980s and 1990s can be attributed to binaural fittings. However, MarkeTrak VI23 reported that the binaural purchase rate in 2000 among bilateral loss consumers was 84.5%, and 74.2% among all hearing aid consumers. In 2004, the binaural fitting rate in the US hovered somewhere around 73%3 to 74%.23

10 Best-Practices Protocol. Evidence-based practices are gaining steam, representing a more scientific approach to hearing instrument dispensing. Researchers will continue to find those things that work well, as well as those that don’t. Eventually, a list of “best-practices” will emerge—or a list of items that the most successful offices/practices do to attain the highest levels of customer satisfaction.

Correspondence can be addressed to Karl Strom, editor-in-chief, email: [email protected].

References

1. Hearing Industries Assn. HIA Statistical Reporting Program, Third Quarter 2005. Alexandria, Va; October 2005.

2. Kochkin S. MarkeTrak VII: Hearing Loss Population Tops 31 Million People. The Hearing Review. 2005;12(7):16-29.

3. Strom KE. The HR 2005 dispenser survey. The Hearing Review. 2005;12(6):18-36,72.

4. Bray V. New digital aid designed for enhanced directionality. The Hearing Review. 2005;12(1):44-47.

5. Powers TA, Hamacher V. Proving adaptive directional technology works: A review of studies. The Hearing Review. 2004;11(4):46-49,69.

6. Fabry DA. Adaptive directional microphone technology and hearing aids: Theoretical and clinical implications. The Hearing Review. 2005;12(4):22-25,81-82.

7. Olson L, Trine T. Fitting automatic directional hearing aids. The Hearing Review. 2004;11(7):24-28.

8. Kuk F, Keenan D, Lau C. Preserving audibility in directional microphones: Implications for adults and children. The Hearing Review. 2005;(12)12:62-66.

9. Killion MC. Myths about hearing in noise and directional microphones. The Hearing Review. 2004;11(2):14-19,72-73.

10. Strom KE. HR Interviews Sergei Kochkin, PhD. The Hearing Review. 2005;12(9):24-32,82.

11. Dietrich S. Road test: An FM system in a dental office/educational setting. The Hearing Review. 2005;12(1):38-42.

12. Rogers Scholl J. Using WiFi technology for children with unilateral hearing loss. The Hearing Review. 2005;12(5):44-46.

13. Powers TA, Burton P. Wireless binaural synchronization in hearing aids. The Hearing Review. 2005;12(1):28-30,89.

14. Ingrao B. Bluetooth technology: Toward more wireless hearing care solutions. The Hearing Review. 2005;12(1):26-27,88-89.

15. Tchorz J, Schulte M. Utilizing Bluetooth for better speech understanding over the cell phone. The Hearing Review. 2005;12(3):50-51,80.

16. Yanz J, Roberts R, Sanguino J. A wearable Bluetooth device for hard-of-hearing people. The Hearing Review. 2005;12(5):38-41.

17. Yoshinaga-Itano C, Sedey AL, Coulter DK, Mehl AL. Language of early- and later-identified children with hearing loss. Pediatrics. 1998;102(5):1161-1171.

18. Kochkin S, Rogin C. Quantifying the obvious: The impact of hearing aids on quality of life. The Hearing Review. 2000;7(1):8-34.

19. Larson VD et al. Efficacy of 3 commonly used hearing aid circuits. JAMA. 2000;284(14):1806-1813.

20. Yeuh B, Shapiro N, MacLean CH, Shekelle PG. Screening and management of adult hearing loss in primary care: Scientific review. JAMA. 2003;15(289):1976-1985.

21. Better Hearing Institute. Hearing loss and its impact on household income. The Hearing Review. 2005:12(11);16-24.

22. Taylor B. Why quality matters. The Hearing Review. 2005;12(9):36-38,76-77.

23. Kochkin S. MarkeTrak VI: The VA and direct mail sales spark growth in hearing aid market. The Hearing Review. 2001;8(12):16-24,63-65.

24. Sweetow R. Physical therapy for the ears: Maximizing patient benefit using a listening retraining program. The Hearing Review. 2005;12(10):56-58.

25. Flynn M. Envirograms: Bringing greater utility to datalogging. The Hearing Review. 2005;12(12):32-38.

26. Kasewurm G. A multimedia fitting tool for a patient-driven protocol. The Hearing Review. 2004;11(11):40-42.

27. Kuk F, Bülow M, Damsgaard A. Hearing aid fittings and the use of simulated sound environments. The Hearing Review. 2004;11(9):42-49.

28. Pehringer JL. Fine-tuning hearing instruments using an economical sound simulator. The Hearing Review. 2005;12(6):50-52.

29. Ingrao B. E-business: Connecting hearing care professionals and their suppliers. The Hearing Review. 2005;12(9):18-22.

30. Pirzanski C, Berge B. Is the end near for acoustic feedback? The Hearing Review. 2004;11(4):18-23.

31. Cortez R, Dinulescu N, Skafte K, Olson B, Keenan D, Kuk F. Changing with the times: Applying digital technology to hearing aid shell manufacturing. The Hearing Review. 2004;11(3):30-38.

32. Fabry DA, Tchorz J. A hearing system that can bounce back from reverberation. The Hearing Review. 2005;12(10):48-50.

33. Schweitzer HC, Smith DA. Reducing the negative effect of reverberation in hearing aid processing. The Hearing Review. 2003;10(12):24-28.

34. Killion MC. Myths that discourage improvements in hearing aid design. The Hearing Review. 2004;11(1):32-40,70.

35. Strom KE. Oticon celebrates its centennial. The Hearing Review. 2004;11(11):22-29,66.